Every year, Euromonitor International identifies emerging and fast-moving trends that are expected to gain traction in the year ahead. These trends provide insight into changing consumer values, exploring how consumer behaviour is shifting and causing disruption for businesses globally. The most prominent trend in the region is the pursuit of preloved, where consumers continuously take stock of their belongings to determine which items to keep, upgrade, resell or donate.

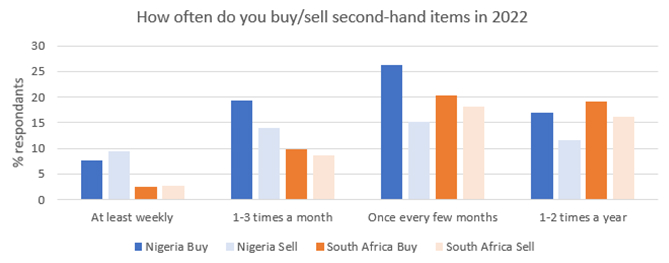

The African second-hand clothing market, known as Madunusa in South Africa, Okrika in Nigeria, and Mtumba in Kenya, is as diverse as its purveyors. It ranges from basic everyday use worn clothes to luxury apparel aimed at higher-income consumers with a taste for luxury brands but not necessarily the budget to quench such tastes – and everything in-between, which consumers call ‘thrift’. According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey 2022, second-hand clothing is more popular among Nigerians, with nearly 10% reporting buying and selling used items at least once a week.

There is a misconception that second-hand clothing sold in open markets across Africa is bought only by consumers at the bottom of the pyramid. Owners of preloved clothing shops are also regular customers of such open markets, browsing the heaps of clothes across stalls in search of well-known brands which are in excellent condition to resell in their trendier and more upmarket thrift shops.

Are economic challenges the only reason for the growth of second-hand clothing?

While consumers in more formalised markets such as South Africa have a plethora of options, the reality is quite different in other African countries, where apparel options are limited due to the low penetration of modern retail. Customers can either buy from the few stores available, which are perceived as overpriced, have their clothes custom-made by local tailors, or buy high-quality European brands as second-hand clothing.

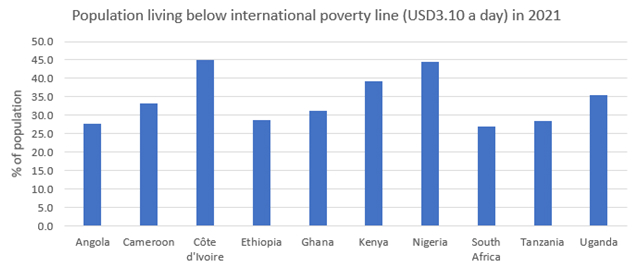

In a region where a high proportion of the population lives below the poverty line, second-hand clothing is often the first choice. Consumers in Kenya can buy multiple second-hand items for KES1,000, while a new T-shirt costs around KES3,000. In South Africa’s Madunusa, branded T-shirts retail for as low as ZAR5, while a simple black T-shirt sells for ZAR59.99 at low-cost retailer Pep.

More recently, economic challenges have accelerated the allure of second-hand, broadening the customer base to include consumers with higher income profiles. They do, however, prefer to shop online or in better-maintained thrift stores. Pre-owned luxury is also gaining popularity among aspirational consumers who want to own luxury labels but do not have the budget to do so.

Route to market for second-hand clothing

The second-hand clothing industry has a low entry barrier, which means that anyone can become a reseller with little investment. However, at the government level, some countries are stricter than others, even though such laws are often poorly enforced. Nigeria, for example, has a complete ban on the importation of second-hand clothing to help revive local manufacturing companies, yet Okrikas thrive.

From the moment the second-hand clothing bales reach the disembarkation ports, they change hands multiple times before reaching the final consumer. The latter can be in the same country, or in neighbouring countries where the sale of second-hand clothing is banned or comes with high tax implications.

Second-hand clothing offers opportunities for governments to grow revenue and create jobs

According to the #StateofMitumbaTradeKE, 42% of all expenditure on clothing and footwear in 2019 was on second-hand clothing and footwear in Kenya. Approximately two million people work in the second-hand clothing industry in Kenya, according to the Kenya National Bureau of Statistics, contributing over KES12 billion in taxes annually. Since 2015 the volume of second-hand clothing has increased by 66%, driven by the growth in local demand.

Given the scale of the second-hand clothing market in sub-Saharan Africa, it should come as no surprise that this offers an abundance of opportunities for governments to create employment opportunities. The COVID-19 pandemic highlighted the importance of local production, not only to boost local economies, but also to be more resilient during global crises when supply chains are disrupted. However, the growing demand for second-hand clothing raises serious concerns about the impact this market has on the local textile industry.

Emerging trends in Africa driven by the second-hand clothing market

While the pursuit of preloved was the dominant trend in the region, other trends identified by Euromonitor play out in Africa, driven by the large second-hand market. Financial aficionados take control of their money and use services to track their transactions. While this trend is in its infancy, mobile money is playing a big part in how businesses fulfil smooth payment transactions, especially within the informal market.

Aside from economically motivated reasons, only a small subset of consumers supports second-hand fashion for sustainability reasons. These climate changers make more sustainable choices whilst demanding action and transparency from brands. As life returns to some form of normal, consumers crave comfort and luxury. They are no longer in survival mode; instead, consumers are embracing the future and are proud of overcoming hardships.

Self-love seekers indulge in themselves, splurging in ways that match their lifestyles, such as luxury fashion. However, affordability and access often hamper their desires coming to fruition.

Crises can make people analyse and change their values. In the past year, consumers took stock of their lives and are now actively trying to chart a new path forward. The pandemic triggered consumers to make The Great Life Refresh, resulting in drastic personal changes and a collective reboot of values, lifestyles and goals.

While some of these trends are continuously evolving, African consumers will continue to prioritise affordability in their purchasing decisions. Preloved is expected to continue rising in popularity and cut across other industries as the consumer environment worsens. Finally, businesses should tailor their product offerings to meet the rapidly changing needs of African consumers. The world is becoming more integrated, and due to social media and online shopping, so is the consumer.

Source : Euro Monitor International